Reports | United States

USA E-Commerce Logistics Market Report 2023

Analyzing Key Delivery Performance, Consumer Preferences, and Technology Trends Fueling U.S. E-Commerce Growth

The United States holds a major share of the North American e-commerce logistics market owing to its advancement in logistics technologies. Over the past decade, the country's online sales have demonstrated a steady annual increase of 13% to 18%, and the market is projected to maintain this upward trend with a compound annual growth rate (CAGR) of over 6% between 2023 and 2028.

With this in mind, let us delve deeper into the state of e-commerce and delivery performance of the United States, a country that is home to the second-largest e-commerce market in the world, not far behind China and Japan.

Here's what you can expect from downloading the full report:

1) E-Commerce Logistics Landscape in the United States

In recent years, the U.S. e-commerce logistics industry has witnessed a rise in the adoption of innovative technologies aimed at enhancing efficiency, reducing costs, and improving the overall customer experience. One such innovation is the use of automation in warehouses and distribution centers, which has led to significant improvements in the

speed and accuracy of fulfillment logistics.

As per LogisticsIQ’s latest market research study, Warehouse Automation Market will reach the milestone of $30 billion by 2026, at a CAGR of around 14% between 2020 and 2026. In addition, several companies have also invested in expanding their fulfillment network and optimizing their delivery routes, which have both contributed to the overall improvement in parcel transit time across the country.

2) Consumer Preferences Among U.S. Shoppers

According to Rakuten Insight Global's recent survey, consumers in the U.S. tend to value cost and speed above all else when it comes to delivery experiences. This suggests that in order to remain competitive and meet the needs of this group, businesses have to prioritize cost and speed while also taking sustainability and convenience into consideration.

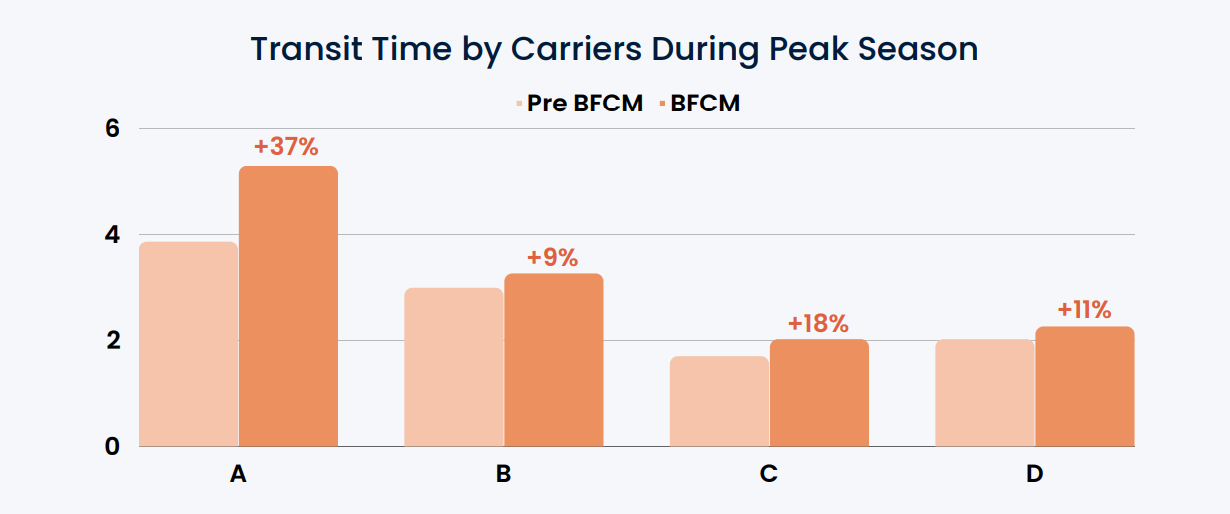

3) Peak Season Performance by 4 Major Carriers in the U.S.

During Black Friday and Cyber Monday 2022, we noticed an increase in transit time for parcels across all four major carriers in the United States, which was expected given the surge in e-commerce orders around this period. More specifically, Carrier A had the largest increase in transit time (+37%) during the peak season, followed by Carrier C (+18%), Carrier D (+11%), and Carrier B (+9%).

For the full analysis, download the free report now (exclusive to Parcel Monitor members).

Trusted by top brands, marketplaces and carriers worldwide:

Discover what Parcel Perform can do for your business.

Turn your e-commerce delivery process into your business advantage.

Parcel Perform is ISO 27001 certified by TÜV SÜD PSB Pte Ltd

Fully GDPR-compliant platform